Client and Context: Unlocking Scalability for a Leading Pharma Giant

The client is a leading pharmaceutical firm with a broad market presence and operations spanning multiple continents. Despite its global reach, the organization’s financial data analysis and reporting systems were highly dependent on manual, Excel-based workflows and lacked the depth needed for market- and product-specific insights. This dependency caused discrepancies in formatting and currency conventions between regions, leading to low availability of accurate and actionable data.

As the volume and complexity of their operations developed, the limitations made it increasingly difficult to monitor trends, identify vulnerabilities, and make data-driven decisions. This indicated an urgent need for a scalable, technology-driven evolution to update financial analytics and improve decision-making processes.

Challenges: Manual Workflows Hindering Growth and Insight

The client encountered many critical issues with their financial analytics procedures, resulting mostly from obsolete manual workflows. These difficulties were not only slowing down their operations but also preventing them from utilizing their data efficiently. These are some of the main challenges faced:

• Static Reporting: Insights were constrained to static Excel reports based on region-specific templates, requiring substantial manual effort for deeper examination. They lacked the flexibility to change or scale as business demands grew.

• Limited Scalability: Manual procedures struggled to keep pace with the expanding complexity of the client’s activities. As the volume of data rose, the reliance on manual operations generated inefficiencies.

• Insight Gaps: The absence of sophisticated analytics capabilities made it difficult to convert from descriptive reports to actionable insights. Fragmented data hid important market dynamics, financial trends, and product-specific performance measures.

• Inconsistencies Across Regions: Efforts to compile and analyze information globally were made more difficult by the disparities in currency standards and formatting of financial data.

Solution: An Automated and Scalable Analytics Ecosystem

MResult developed a comprehensive solution that took the client data, transformed it into uniform formats, and presented users a powerful dynamic dashboard. This robust design revolutionized the client’s approach to data management and analysis on multiple fronts:

• Data Management and Transformation: To speed up data loading, processing, and transformation, MResult employed AWS Glue to manage ETL pipelines. Raw data from the client's unified data hub was transformed into a staging table in an Aurora database. To ensure that financial measures were consistent across regions, a robust data model was developed to handle complex transformation tasks.

• Phased Data Engineering: To process, validate, and publish data into a target table on the database, the team used a phased method. Performance and user experience were enhanced by this design, which relied on the backend to do the complex work and enabled a fast frontend dashboard experience. These database-level changes ensured quick data processing and smooth scalability.

• Dynamic Visualization: Because of its safe and user-friendly design, MicroStrategy was selected as the visualization tool. The drill-down capabilities offered by the custom dashboard MResult created allowed users to examine data at different granular levels. The inclusion of self-serve reporting capabilities reduced dependency on IT specialists by enabling users to create personalized reports suited to their own requirements.

• Role-Based Access and Security: To make certain that only authorized workers could access sensitive financial data, the dashboard included strong security features, such as role-based access restrictions.

Overall, MResult helped the client move from disjointed, manual procedures to an automated, scalable analytics ecosystem by tackling these issues.

Technology Overview

Python | Pyspark | AWS Glue | Aurora | Microstrategy

Benefits: Static Sheets to Dynamic Dashboards

The implementation of the solution delivered a range of tangible benefits for the client, transforming their financial analytics into a streamlined, efficient process. Notable improvements include:

• Efficiency Gains: Automated workflows replaced time-intensive manual processes, reducing manual effort by up to 60%. Analysts and finance teams were able to shift their focus from operational tasks to strategic initiatives.

• Faster Insights: Backend data refresh times were reduced to under 5 seconds, enabling near-real-time access to actionable information. Reports that previously took hours to prepare could now be generated in minutes.

• Deeper Analysis: The new dashboards allowed users to drill down from high-level overviews to detailed market-, product-, and trend-specific insights. This capability empowered teams to identify underperforming areas, optimize strategies, and drive growth.

• Error Reduction: The elimination of manual calculations significantly reduced the risk of human errors, enhancing the reliability and trustworthiness of financial data. Accurate, standardized reports enabled faster and more informed decision-making across departments.

• Future-Ready Scalability: The cloud-based architecture was designed to accommodate growing data complexity. As the client’s operations expanded, the solution could seamlessly scale to handle increased volumes of data and analytics demands.

Impact: Revolutionizing Financial Intelligence

The client’s perspective to financial intelligence was fundamentally altered by MResult’s solution, which marked a significant turning point in their business. The system provided long-lasting value in several ways, such as facilitating quick data refresh, user-friendly drill-down capabilities, and self-serve reporting. Financial patterns could be quickly identified and addressed by teams, guaranteeing proactive handling of issues and quick identification of business opportunities. Workflows were made more efficient by automated procedures, which also improved resource use and replaced antiquated manual techniques. The carefully crafted dashboard greatly increased user involvement, which promoted a data-driven culture in the organization.

About MResult

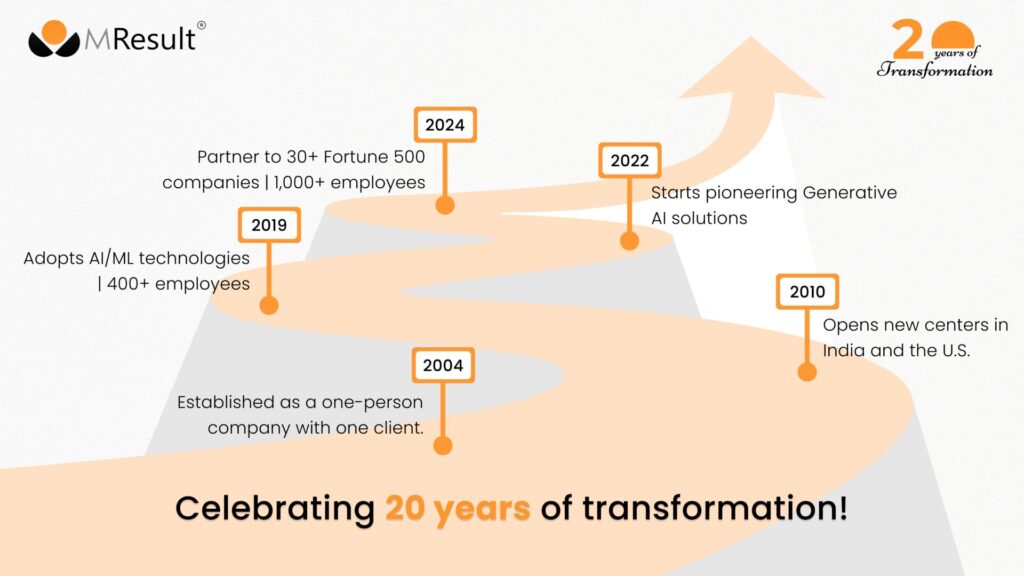

MResult is a global consulting and information technology firm specializing in enterprise analytics, decision sciences, Generative AI and custom application development. Founded in 2004, the company has grown into a multinational enterprise, serving 5 among top 10 pharma companies and 30+ global Fortune 500 organizations across various industries with innovative, data-driven solutions.

For more information, visit www.mresult.com.